References

- Bertram G, Simon T: The Carbon Challenge: New Zealand’s Emissions Trading Scheme. . Wellington: Bridget Williams Books; 2010.

- Wright J. Addendum to the Submission on the Climate Change Response (Emissions Trading and Other Matters) Amendment Bill. Submission to the Finance and Expenditure Committee. Wellington: Parliamentary Commissioner for the Environment, 2012. http://www.pce.parliament.nz/media/pdfs/PCE-Submission-on-the-Climate-Change-Amendment-Bill.pdf

- Ecofys World Bank. State and trends of carbon pricing 2014. Washington: World Bank, 2014.

- Chapman R: Time of Useful Consciousness: Acting Urgently on Climate Change Wellington: Bridget Williams Books; 2015.

- Transparency International. https://www.transparency.org/news/feature/corruption_perceptions_index_2017

- New Zealand Government: Government Response to the Report of the Māori Affairs Committee on its Inquiry into the tobacco industry in Aotearoa and the consequences of tobacco use for Māori (Final Response). Wellington: New Zealand (NZ) Parliament, 2011. http://www.parliament.nz/en-nz/pb/presented/papers/49DBHOH_PAP21175_1/government-final-response-to-report-of-the-m%c4%81ori-affairs; 2011.

- Gendall P, Hoek J, Edwards R. What does the 2025 Smokefree Goal mean to the New Zealand public? N Z Med J. 2014;127(1406):101-103.

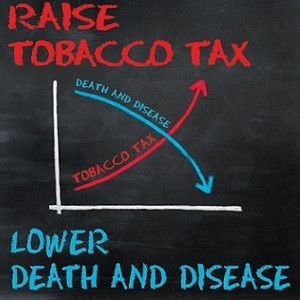

- Summers LH. Taxes for health: evidence clears the air. Lancet. 2018.

- Demerse C. Proof Positive The Mechanics and Impacts of British Columbia’s Carbon Tax. Clean Energy Canada, 2014. http://cleanenergycanada.org/wp-content/uploads/2014/12/Carbon-Tax-Fact-Sheet.pdf.

- Hiscock R, Branston JR, McNeill A, Hitchman SC, Partos TR, Gilmore AB. Tobacco industry strategies undermine government tax policy: evidence from commercial data. Tob Control. 2017.

- Wilson N, van der Deen F, Edwards R, Thomson G, Waa A, Blakely T. Patterns of Declining Smoking in NZ – But More Action Needed by the New Government. Public Health Expert (Blog). 20 November 2017. https://blogs.otago.ac.nz/pubhealthexpert/2017/11/20/patterns-of-declining-smoking-in-nz-but-more-action-needed-by-the-new-government/.

- Health Promotion Agency. Tobacco Control Data Repository: Four weekly equivalent sales volume (January 2011 to January 2016). http://www.tcdata.org.nz/Sales%20data/Sales_06.aspx.

- Cobiac LJ, Ikeda T, Nghiem N, Blakely T, Wilson N. Modelling the implications of regular increases in tobacco taxation in the tobacco endgame. Tob Control. 2015;24(e2):e154-160.

- Blakely T, Cobiac LJ, Cleghorn CL, Pearson AL, van der Deen FS, Kvizhinadze G et al. Health, health inequality, and cost impacts of annual increases in tobacco tax: Multistate life table modeling in New Zealand. PLoS Med. 2015;12(7):e1001856. [Correction at: http://journals.plos.org/plosmedicine/article?id=1001810.1001371/journal.pmed.1002211].

- van der Deen FS, Wilson N, Cleghorn CL, Kvizhinadze G, Cobiac LJ, Nghiem N et al. Impact of five tobacco endgame strategies on future smoking prevalence, population health and health system costs: two modelling studies to inform the tobacco endgame. Tob Control. 2017;(E-publication 24 June).

- Cleghorn CL, Blakely T, Kvizhinadze G, van der Deen FS, Nghiem N, Cobiac LJ et al. Impact of increasing tobacco taxes on working-age adults: short-term health gain, health equity and cost savings. Tob Control. 2017.

- National Academies of Sciences E, and Medicine,. Public health consequences of e-cigarettes. Washington, DC: The National Academies Press, 2018. doi: https://doi.org/10.17226/24952.

- Ministry of Health. Annual Update of Key Results 2015/16: New Zealand Health Survey. Wellington: Ministry of Health, 2016.

- Boden JM, Fergusson DM, Horwood LJ. Alcohol misuse and criminal offending: findings from a 30-year longitudinal study. Drug Alcohol Depend. 2013;128(1-2):30-36.

- Gmel G, Rehm J. Harmful alcohol use. Alcohol Res Health. 2003;27(1):52-62.

- Shield KD, Parry C, Rehm J. Chronic diseases and conditions related to alcohol use. Alcohol Res. 2013;35(2):155-173.

- Wood A, Kaptoge S, Butterworth A, Et al. Risk thresholds for alcohol consumption: combined analysis of individual-participant data for 599912 current drinkers in 83 prospective studies. Lancet. 2018;391:1513–1523.

- Parry CD, Patra J, Rehm J. Alcohol consumption and non-communicable diseases: epidemiology and policy implications. Addiction. 2011;106(10):1718-1724.

- Connor J, Casswell S. The burden of road trauma due to other people’s drinking. Accident; analysis and prevention. 2009;41(5):1099-1103.

- Connor J, Casswell S. Alcohol-related harm to others in New Zealand: evidence of the burden and gaps in knowledge. N Z Med J. 2012;125(1360):11-27.

- Connor J, You R, Casswell S. Alcohol-related harm to others: a survey of physical and sexual assault in New Zealand. N Z Med J. 2009;122(1303):10-20.

- Institute of Health Metrics and Evaluation. Country profiles: New Zealand. (Accessed 10 April 2018). http://www.healthdata.org/results/country-profiles.

- Law Commission: Alcohol In Our Lives: An Issues Paper on the reform of New Zealand’s liquor laws. Wellington: Law Commission; 2009.

- Elder RW, Lawrence B, Ferguson A, Naimi TS, Brewer RD, Chattopadhyay SK et al. The effectiveness of tax policy interventions for reducing excessive alcohol consumption and related harms. Am J Prev Med. 2010;38(2):217-229.

- Wagenaar AC, Tobler AL, Komro KA. Effects of alcohol tax and price policies on morbidity and mortality: a systematic review. Am J Public Health. 2010;100(11):2270-2278.

- Cobiac L, Vos T, Doran C, Wallace A. Cost-effectiveness of interventions to prevent alcohol-related disease and injury in Australia. Addiction. 2009;104(10):1646-1655.

- Ashton T, Casswell S, Gilmore L. Alcohol taxes: do the poor pay more than the rich? British journal of addiction. 1989;84(7):759-766.

- Ministry of Health. Annual Update of Key Results 2016/17: New Zealand Health Survey. Wellington, Ministry of Health, 2017. https://www.health.govt.nz/publication/annual-update-key-results-2016-17-new-zealand-health-survey.

- Backholer K, Blake M, Vandevijvere S. Sugar-sweetened beverage taxation: an update on the year that was 2017. Public Health Nutr. 2017;20(18):3219-3224.

- Colchero MA, Molina M, Guerrero-Lopez CM. After Mexico Implemented a Tax, Purchases of Sugar-Sweetened Beverages Decreased and Water Increased: Difference by Place of Residence, Household Composition, and Income Level. The Journal of nutrition. 2017;147(8):1552-1557.

- Colchero MA, Rivera-Dommarco J, Popkin BM, Ng SW. In Mexico, Evidence Of Sustained Consumer Response Two Years After Implementing A Sugar-Sweetened Beverage Tax. Health affairs (Project Hope). 2017;36(3):564-571.

- Falbe J, Rojas N, Grummon AH, Madsen KA. Higher Retail Prices of Sugar-Sweetened Beverages 3 Months After Implementation of an Excise Tax in Berkeley, California. Am J Public Health. 2015;105(11):2194-2201.

- Falbe J, Thompson HR, Becker CM, Rojas N, McCulloch CE, Madsen KA. Impact of the Berkeley Excise Tax on Sugar-Sweetened Beverage Consumption. Am J Public Health. 2016;106(10):1865-1871.

- Silver LD, Ng SW, Ryan-Ibarra S, Taillie LS, Induni M, Miles DR et al. Changes in prices, sales, consumer spending, and beverage consumption one year after a tax on sugar-sweetened beverages in Berkeley, California, US: A before-and-after study. PLoS Med. 2017;14(4):e1002283.

- Zhong Y, Auchincloss A, Lee B, Kanter G. The short-term impacts of the Philadelphia beverage tax on beverage consumption. Am J Prev Med. 2018;(E-publication 12 April).

- Kim D, Kawachi I. Food taxation and pricing strategies to “thin out” the obesity epidemic. Am J Prev Med. 2006;30(5):430-437.

- Pak T-Y. The Unequal Distribution Of Body Mass Index: Examining The Effect Of State-Level Soft Drink Taxes On Obesity Inequality. University of Georgia, USA. Masters of Science Thesis, 2013. https://getd.libs.uga.edu/pdfs/pak_tae-young_201305_ms.pdf.

- Sturm R, Powell LM, Chriqui JF, Chaloupka FJ. Soda taxes, soft drink consumption, and children’s body mass index. Health Aff (Millwood). 2010;29(5):1052-1058.

- Gebreab SY, Davis SK, Symanzik J, Mensah GA, Gibbons GH, Diez-Roux AV. Geographic variations in cardiovascular health in the United States: contributions of state- and individual-level factors. J Am Heart Assoc. 2015;4(6):e001673.

- Hashem KM, He FJ, MacGregor GA. Cross-sectional surveys of the amount of sugar, energy and caffeine in sugar-sweetened drinks marketed and consumed as energy drinks in the UK between 2015 and 2017: monitoring reformulation progress. BMJ Open. 2017;7(12):e018136.

- Briggs ADM, Mytton OT, Kehlbacher A, Tiffin R, Elhussein A, Rayner M et al. Health impact assessment of the UK soft drinks industry levy: a comparative risk assessment modelling study. The Lancet Public Health. 2017.

- Blakely T, Nick Wilson N, Mizdrak A, Cleghorn C. And now the Brits are doing it: A sugary drink tax levy on the industry. Public Health Expert (Blog). (3 April 2018). https://blogs.otago.ac.nz/pubhealthexpert/2018/04/03/and-now-the-brits-are-doing-it-a-sugary-drink-tax-levy-on-the-industry/.

- Sundborn G, Thornley S, Lang B, Beaglehole R. New Zealand’s growing thirst for a sugar-sweetened beverage tax. N Z Med J. 2015;128(1422):80-82.

- Moretto N, Kendall E, Whitty J, Byrnes J, Hills AP, Gordon L et al. Yes, the government should tax soft drinks: findings from a citizens’ jury in Australia. Int J Environ Res Public Health. 2014;11(3):2456-2471.

- Donaldson EA, Cohen JE, Rutkow L, Villanti AC, Kanarek NF, Barry CL. Public support for a sugar-sweetened beverage tax and pro-tax messages in a Mid-Atlantic US state. Public Health Nutr. 2015;18(12):2263-2273.

- Simon PA, Chiang C, Lightstone AS, Shih M. Public opinion on nutrition-related policies to combat child obesity, Los Angeles County, 2011. Preventing chronic disease. 2014;11:E96.

- Black R. Sugar levy set to raise £415m to support schools’ fight against obesity. The Telegraph (28 February 2017). http://www.telegraph.co.uk/education/2017/02/28/sugar-levy-set-raise-415mto-support-schools-fight-against-obesity/.

- Taillie LS, Rivera JA, Popkin BM, Batis C. Do high vs. low purchasers respond differently to a nonessential energy-dense food tax? Two-year evaluation of Mexico’s 8% nonessential food tax. Prev Med. 2017;105S:S37-S42.

- Colchero MA, Zavala JA, Batis C, Shamah-Levy T, Rivera-Dommarco JA. [Changes in prices of taxed sugar-sweetened beverages and nonessential energy dense food in rural and semi-rural areas in Mexico]. Salud Publica Mex. 2017;59(2):137-146.

- European Commission: Survey on members states implementation of the EU salt reduction framework: Directorate-General Health and Consumers. Available from: http://ec.europa.eu/health/nutrition_physical_activity/docs/salt_report1_en.pdf; 2012.

- Nghiem N, Blakely T, Cobiac LJ, Pearson AL, Wilson N. Health and economic impacts of eight different dietary salt reduction interventions. PLoS One. 2015;10(4):e0123915.

- Smith-Spangler CM, Juusola JL, Enns EA, Owens DK, Garber AM. Population strategies to decrease sodium intake and the burden of cardiovascular disease: a cost-effectiveness analysis. Annals of internal medicine. 2010;152(8):481-487, W170-483.

- Cobiac LJ, Tam K, Veerman L, Blakely T. Taxes and Subsidies for Improving Diet and Population Health in Australia: A Cost-Effectiveness Modelling Study. PLoS Med. 2017;14(2):e1002232.

- Ajmal A, U V. Tobacco tax and the illicit trade in tobacco products in New Zealand. Aust N Z J Public Health. 2015;39(2):116-120.

- Petrovic-van der Deen FS, Wilson N. Restricting tobacco sales to only pharmacies as an endgame strategy: are pharmacies likely to opt in? Aust N Z J Public Health. 2018;42(2):219-220.

- Pearson AL, van der Deen FS, Wilson N, Cobiac L, Blakely T. Theoretical impacts of a range of major tobacco retail outlet reduction interventions: modelling results in a country with a smoke-free nation goal. Tob Control. 2014;24:e32-e38.

- Pearson AL, Cleghorn CL, van der Deen FS, Cobiac LJ, Kvizhinadze G, Nghiem N et al. Tobacco retail outlet restrictions: health and cost impacts from multistate life-table modelling in a national population. Tob Control. 2016;(E-publication 22 September).

- Wilson N, Thomson G, Tobias M, Blakely T. How much downside? Quantifying the relative harm from tobacco taxation. J Epidemiol Community Health. 2004;58(6):451-454.

- Thornley L, Edwards R, Waa A, Thomson G: Achieving Smokefree Aotearoa by 2025. University of Otago, ASPIRE 2025, Quitline, Hapai Te Hauora, 2017. https://aspire2025.files.wordpress.com/2017/08/asap-main-report-for-web2.pdf.

- Wilson N, Thomson G. Tobacco taxation and public health: ethical problems, policy responses. Soc Sci Med. 2005;61(3):649-659.

- Wilson N, Weerasekera D, Edwards R, Thomson G, Devlin M, Gifford H. Characteristics of smoker support for increasing a dedicated tobacco tax: national survey data from New Zealand. Nicotine Tob Res. 2010;12(2):168-173.

About the Briefing

Public health expert commentary and analysis on the challenges facing Aotearoa New Zealand and evidence-based solutions.

Subscribe

Public Health Expert Briefing

Get the latest insights from the public health research community delivered straight to your inbox for free. Subscribe to stay up to date with the latest research, analysis and commentary from the Public Health Expert Briefing.